Steel prices are skyrocketing! Many steel mills have raised prices significantly! Will steel prices continue to rise this week?

1. International News

- The U.S. Secretary of Commerce said that he might meet with the Chinese negotiation representative in early August. The Ministry of Commerce responded: Currently, the two sides are maintaining close communication at multiple levels regarding their respective concerns in the economic and trade fields.

- On the local time of the 7th, U.S. President Trump signed an executive order to extend the so-called "reciprocal tariff" moratorium, delaying the implementation time from July 9 to August 1.

- On the local time of July 10, U.S. President Trump announced that starting from August 1, a 35% tariff will be imposed on goods imported from Canada.

- On the local time of July 10, when U.S. President Trump accepted a telephone interview from the U.S. media, he said that he planned to impose a unified tariff of 15% or 20% on almost all trading partners that have not yet been subject to tariffs.

- Market news: Nippon Steel plans to double its steel production in the United States within five years.

- The uncertainty of U.S. trade policy has suppressed market confidence, and the U.S. stock market has corrected. Major stock indexes have generally declined, reflecting the rising concern of investors about the trade situation becoming tense again.

- The global manufacturing purchasing managers' index in June was 49.5%, an increase of 0.3 percentage points from the previous month, rising month - on - month for two consecutive months.

- The IMF issued a warning that the "Big and Beautiful" Act runs counter to the reduction of the fiscal deficit, and market concerns have intensified.

2. Chinese News

- The scale of China's GDP in 2025 is expected to be around 140 trillion yuan.

- National Bureau of Statistics: In June 2025, China's PPI decreased by 3.6% year - on - year and 0.4% month - on - month. China's CPI increased by 0.1% year - on - year and decreased by 0.1% month - on - month.

- 33 construction - related enterprises jointly issued an "anti - involution" initiative for the construction industry to jointly promote the transformation of the industry and abandon "involution - style" competition.

- The National Development and Reform Commission recently newly allocated and issued 10 billion yuan of central budgetary investment to carry out the work - as - relief effort to expand domestic demand and promote the employment and income - increasing actions of key groups.

- Many places have intensively introduced policy measures to support the merger and reorganization of state - owned enterprises within their jurisdictions. Driven by policy dividends, cases of merger and reorganization of state - owned enterprises in various places have frequently emerged.

- On July 6, Vietnam's anti - dumping duties on hot - rolled coils exported to China officially took effect. From January to May 2025, the export volume of hot - rolled coils involved in the case from China to Vietnam decreased by 43.6% year - on - year, dropping to 2.307 million tons.

3. Steel Market Dynamics

Steel Enterprise Production Status

- Blast furnace operating rate: 83.15%, a decrease of 0.31% from the previous week, and an increase of 0.65% compared to the same period last year.

- Daily pig iron output: 2.3981 million tons, a decrease of 10,400 tons from the previous week.

- Utilization rate of blast furnace ironmaking capacity: 89.9%, a decrease of 0.39% from the previous week, and an increase of 1.20% compared to the same period last year.

Steel Enterprise Profitability Status

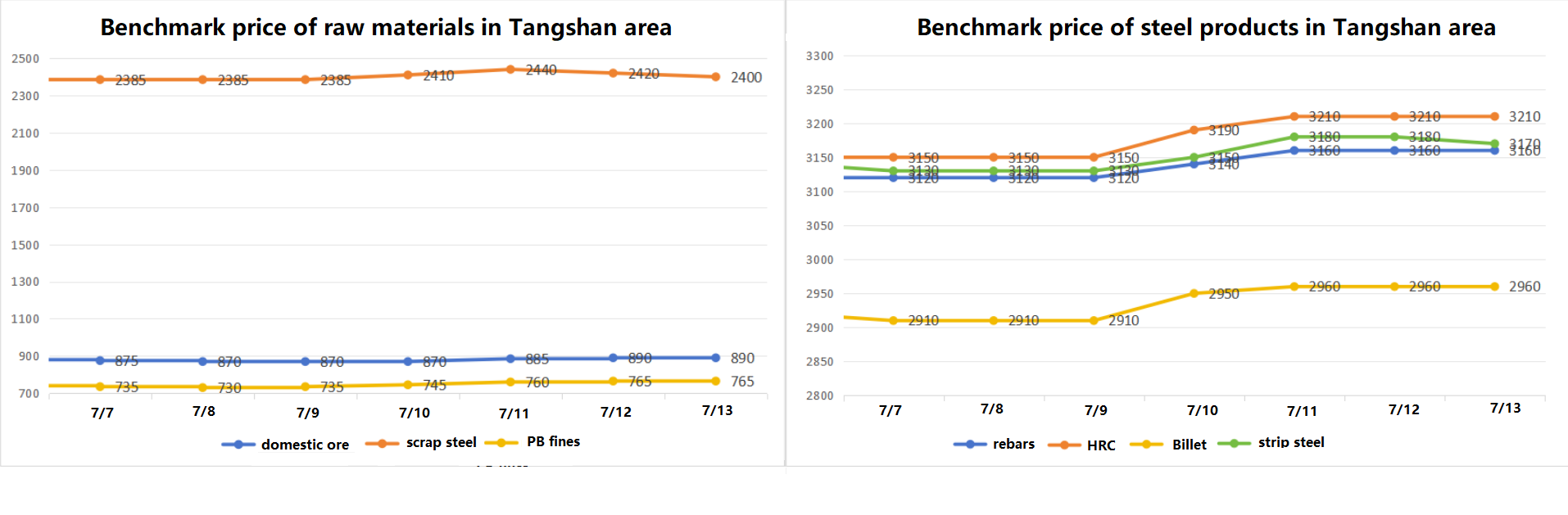

- Steel enterprise cost situation: Last week, the average tax - free cost of pig iron for Tangshan mainstream sample steel mills was 2019 yuan/ton, and the average tax - included cost of Steel Billets was 2759 yuan/ton, a weekly decrease of 15 yuan/ton.

- Steel enterprise profitability situation: Compared with the current ex - factory price of 2960 yuan/ton from the front - end on July 11, the average profit of steel mills was 201 yuan/ton, a weekly increase of 55 yuan/ton.

- Steel enterprise profit rate: 59.74%, an increase of 0.43% from the previous week, and an increase of 22.94% compared to the same period last year.

- Profitability situation of independent electric arc furnaces: On July 10, the average cost of 76 independent electric arc furnace steel mills for construction steel was 3270 yuan/ton, a daily increase of 8 yuan/ton, with an average profit and loss of - 106 yuan/ton, and a profit and loss of - 3 yuan/ton for valley electricity.

Steel Market Supply and Demand

- Supply volume: The supply of five major steel products was 872.72 tons, a weekly decrease of 124,400 tons, a reduction of 1.4%.

- Inventory volume: The total inventory of five major steel products was 13.3958 million tons, a weekly decrease of 35,000 tons, a reduction of 0.03%.

- Consumption volume: The weekly consumption volume of five major varieties was 873.07 tons, a decrease of 1.4%; among them, the consumption of construction materials decreased by 2% month - on - month, and the consumption of plates decreased by 1.8% month - on - month.

Production Suspension, Resumption and Production Adjustment

- Shanxi Meijin Iron And Steel plans to start the overhaul of a 1080m³ blast furnace on July 15, which will affect the daily pig iron output by about 30,000 tons, and the resumption time is to be determined.

- A steel mill in the East China Fujian reGIon plans to resume production on July 15, involving two 105T electric arc furnaces, affecting the daily output by about 30,000 tons; a steel mill in the South China Guangdong region plans to resume production on July 15, involving two 75T electric arc furnaces, affecting the daily output by about 10,000 tons.

- Currently, the production restriction notice in Shanxi is still at the verbal communication stage and has not yet formed an official document. Some steel mills revealed that the production restriction instructions they received will comprehensively determine the specific production restriction volume based on the production volume in the first half of the year and the total production volume last year. The production restriction ratio is expected to fluctuate between 10% and 13%, but the specific production restriction time has not yet been clarified.

Steel Mill Price Adjustment Information

- In August, the ex - factory price of Baowu Steel Plant increased. The base prices of thick plates, hot - rolled, pickled, non - oriented silicon steel, cold - rolled, hot - dip galvanized, electro - galvanized, medium - aluminum zinc - aluminum - magnesium, high - aluminum zinc - aluminum - magnesium, galvanized aluminum, color - coated, etc. increased by 100 yuan/ton.

- Angang, Benxi Steel, and Lingang released the product price policy for August 2025. The prices of varieties such as hot - rolled, cold - rolled, pickled, wire rods, and Rebar generally increased by 100 yuan/ton, and the price of medium - thick plates increased by 50 yuan/ton. The prices of varieties such as galvanized, non - oriented silicon steel, color - coated, and seamless pipes remained unchanged.

- Shagang released the ex - factory price for the middle of July. The price of rebar increased by 50, and the price of coiled rebar increased by 50. The current price of rebar is 3300, and the price of coiled rebar is 3460.

- Zhongtian Iron and Steel released the price for the middle of July. The price of rebar increased by 80, and the price of wire rods and coiled rebar increased by 80. The rebar in East China is 3330, and the wire rods and coiled rebar are 3580.

4. Market Analysis

Billets

Last week's billet prices rose

Last week, billet prices generally increased by 50 yuan/ton, with leading steel mills in Qian'an quoting 2960 yuan/ton (including tax). At the beginning of the week, affected by the weak performance of rebar futures, spot transactions were sluggish, with only low-priced resources seeing volume. In the middle of the week, production restriction news caused disturbances, but the actual reduction was limited, and the operating rate of billet-processing enterprises continued to decline. Near the weekend, along with the strong rebound of futures, speculative demand was released, coupled with macro positive factors such as manufacturing expansion, pushing prices up slightly. The whole week showed the characteristic of "futures leading the rise, spot following the rise". However, the continuous high temperature and rainy season suppressed terminal demand, keeping overall transactions at a low level.

This week's forecast: The billet market may enter a narrow range consolidation. Bullish factors remain: solid support from raw material costs, continued emotional support from high-level fluctuations in rebar futures, and the continuous fermentation of macro policy expectations. Bearish pressures persist: the substantial improvement in off-season terminal demand is limited, the trend of production reduction in billet-processing enterprises is clear, and the current price has partially digested the expected increase. Under the long-short game, it is expected that the upward space of billets will be limited by the difficulty in increasing transactions, while the downward trend will be supported by costs. The mainstream market is expected to fluctuate in the range of 10-30 yuan. Focus on inventory changes and the implementation of macro policies.

Rebar

Last week's rebar spot prices rose slightly

Last week, domestic construction steel prices edged up, with the average price of rebar increasing by 35 yuan to 3230 yuan/ton, and coiled rebar rising by 28 yuan to 3453 yuan/ton. At the beginning of the week, affected by high temperatures and rainfall, construction in many places slowed down, spot prices fell by 10-30 yuan, and transactions were weak. In the middle of the week, support from raw material costs strengthened, and the rebound of rebar futures boosted market sentiment, with some specifications edging up. Near the weekend, futures and spot prices rose by 20-40 yuan in tandem, releasing speculative demand, but terminal purchases remained cautious.

In terms of supply and demand: The national blast furnace operating rate fell slightly by 0.31%, and molten iron output shrank slightly. The inventory of construction steel in key cities increased by 1.64% month-on-month to 3.8255 million tons (significant inventory accumulation in North China and Central South China). Terminal data showed positive signs (June automobile production and sales increased by more than 13% year-on-year, and construction machinery sales increased by 11%-13% year-on-year).

This week's forecast: The construction steel market may continue to fluctuate with a slightly strong trend, but the upward space is limited. Solid support from the cost side (general increase in billets and raw materials) coupled with the resilience of manufacturing demand (positive data on automobiles and machinery) will underpin steel prices. However, the counter-trend accumulation of inventory in the off-season reflects insufficient actual digestion, and the continuous rainy season suppresses construction progress, making terminal motivation to follow the rise questionable. It is expected that the spot price increase will narrow this week, with the mainstream market fluctuating in the range of 10-30 yuan. Focus on the pace of inventory destocking and the implementation of macro policies.

Hot-rolled Coils

Last week's hot-rolled coil prices rebounded

Last week, hot-rolled coil prices rebounded, with the price center moving upward. The main reasons were the strengthening of raw material costs and disturbances from supply-side news (such as steel mill maintenance), stimulating the rebound of futures and spot markets in tandem. Marginal improvement in fundamentals: The capacity utilization rate of sample steel mills slightly decreased, with output shrinking slightly; social inventory continued to decrease, but factory inventory accumulated slightly. Demand remained weak, with the average daily shipment volume in key cities falling month-on-month. In terms of product spreads, the coil-rebar spread narrowed, and the cold-hot rolled spread expanded slightly. Profit margins remained in the range of 100-200 yuan, supporting production stability.

This week's forecast: The momentum for hot-rolled coils to continue rising is insufficient, and they are expected to enter a narrow range fluctuation. Cost-side support remains, and the destocking of social inventory provides a floor for prices. However, the off-season terminal demand remains weak, and the seasonal weakness of manufacturing restricts transaction volume, coupled with the stable total supply, limiting further upward momentum. Be wary of callback pressure after the fading of futures sentiment. It is expected that the mainstream price will consolidate in the range of 10-30 yuan. Focus on steel mill production scheduling and downstream restocking trends.

Strip Steel

Last week's strip steel prices continued to strengthen

Last week, strip steel prices continued to strengthen, with the average price of 2.5*355mm in key national cities rising by 43 yuan to 3278 yuan/ton. At the beginning of the week, suppressed by weak transactions, downstream welded and galvanized pipe factories had sluggish orders, and traders mainly focused on destocking. In the later part of the week, driven by expectations of the "anti-involution" policy and the sharp rise in coking coal and coke, futures and spot markets rose in tandem, with a single-day increase expanding to 50-60 yuan. Regional differentiation was obvious: Tangshan 145 small narrow strip steel rose by 20-40 yuan, Wuxi in East China rose by 60 yuan, and Lecong in South China rose by 40 yuan.

In terms of supply and demand: Production restrictions led to a decline in Tangshan's sintering operating rate, and steel mill resources flowed downstream, but national warehouse inventory increased by 35,600 tons to 623,900 tons, reflecting insufficient terminal digestion.

This week's forecast: The rising momentum of strip steel may gradually converge, shifting to high-level fluctuation. Policy expectations (the "anti-involution" direction of the Political Bureau meeting) and cost support (coke price increases) still underpin market sentiment. However, inventory accumulation coupled with continued extreme weather in the north and south suppressing construction progress, the momentum for terminal follow-up is limited. It is expected that after a rapid rise, prices will enter a game stage, with downstream on-demand purchasing dominating transactions, and the increase narrowing to the range of 10-30 yuan. Focus on policy implementation intensity and inventory destocking pace.